We offer bookkeeping services from the Bay Area to companies across the country.

Transactional Accounting Processing

We can take on accounts payable and receivable for your business, helping pay your bills on-time and deposit incoming payments properly. Use our cloud-based app to keep track of incoming and outgoing payments.

Payroll

We can handle employee paychecks, including paper check disbursements and direct deposits. We can also take care of employee benefits and vacation time and ensure the appropriate taxes are withheld and paid on-time.

If your business already works with a payroll provider and wants to continue that, we can work with it. We can also help you change providers.

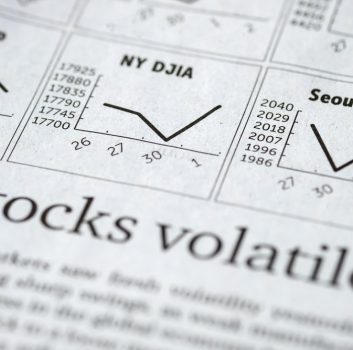

Bank and Investment Reconciliation

Timely reconciliations allow you to make faster decisions about your business. We can collaborate with your company’s investment advisors and develop an investment plan to secure your business’s future funds.

Cash Management and Foreign Exchange

We can provide financial forecasts and projections and analyze your business’s cash flow. We also provide foreign exchange accounting and risk management for international clients.

Financial Statement Preparation

We use Generally Accepted Accounting Principles (GAAP) in the U.S. to provide monthly or quarterly financial statements. We can also present financials to your board of directors.

Budgeting

We can handle all aspects of the budgeting process, from designing and managing a budget to training. We can prepare spreadsheets, develop scenarios, provide variance analysis and interpret the results. We can also present your company’s budget to your board.

Preparation of Audit and Tax Schedules

Our tax team can prepare and file your tax returns while our accounting team can help you stay current on your taxes. If you should be audited, we can answer your auditor’s questions and provide audit support.

Interim Accounting Assistance

Our team can intervene when you need, such as when an accounting clerk takes leave. We can support you through staffing shortages so you can focus on finding the right person for the role.