The beginning of your investment career is an exciting moment in life, full of potential and anticipation. You are likely to get abundant investing advice, maybe even an overwhelming amount of it. The value of professional financial guidance cannot be overstated, but you should choose your advisors carefully.

Raising your own financial literacy will be a crucial step in ensuring that you are investing wisely. One of the cornerstones of a solid investment strategy is diversifying your portfolio, but this is not always intuitive. Investing 101 begins with diversification and ends with a plan that puts you on track to meet all of your financial goals, whatever they may be.

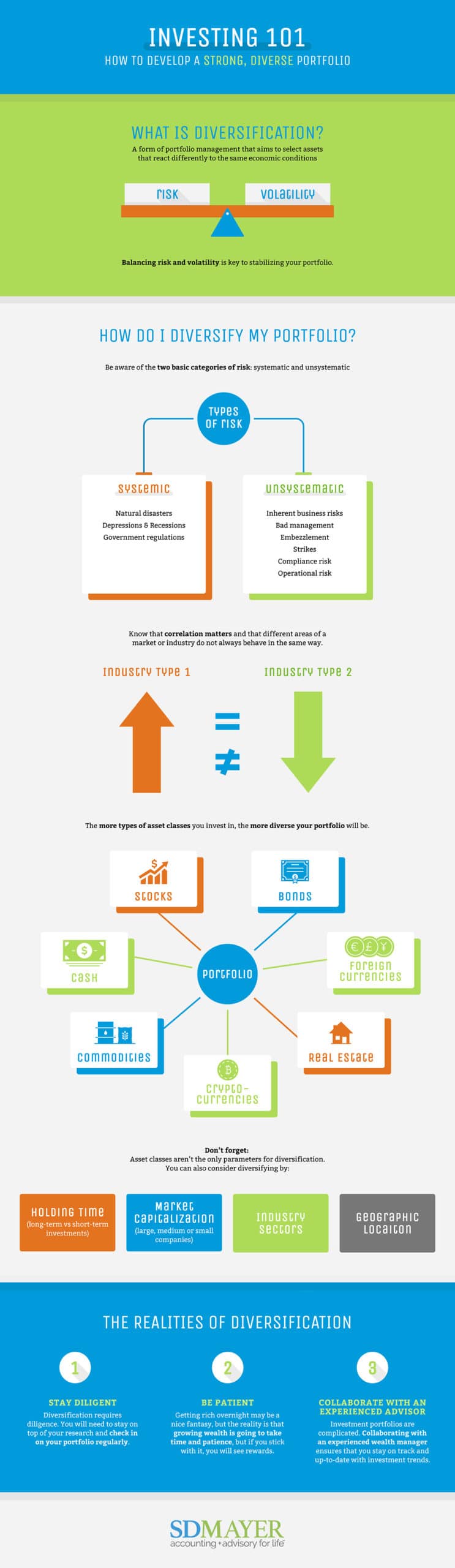

WHAT IS DIVERSIFICATION?

Diversification is a form of portfolio management that aims to select assets that react differently to the same economic conditions. In other words, if one asset loses value for some reason, you should have another one that is expected to gain value in tandem. This reduces the level of risk and volatility in your portfolio.

Risk, in a financial context, is the likelihood of losing money. Every investment is a financial risk, but there is a wide divergence in the degree of risk among investments. The level of risk in your portfolio depends on your assets and the way they are allocated—that is, how the risks are balanced. You do not want to create a risk-free portfolio, as return on investment is generally seen as the reward for accepting risk.

Volatility is a sharp variation in value over a short period. It is not uncommon for the stock market to show volatility, and it is even characteristic for many stocks, as well as other assets. Your investment portfolio is also liable to volatility, which is undesirable because wide variations in the value of your portfolio can lead to problems obtaining financing, and it may limit your financial capacity if you need to cash out assets while your portfolio is at a low point. Portfolio volatility is reduced by allocating assets that have no correlation in their performance, or negative correlation.

The more diverse your investment portfolio, the better you can balance these factors to help mitigate the impacts of ebbs and flows over time.

HOW DO I DIVERSIFY MY PORTFOLIO?

The key questions to ask as you devise a diversification strategy are about your goals and your appetite for risk. Since assets with higher risks generally produce higher returns, these questions are intimately related. Investing is a long-term strategy, and it makes sense to think about your goals in the long term. Investors’ goals are often tied to life events—buying a larger house when you have children, sending the children to college, retiring, creating an estate, and probably a few more crucial moments. Not all the events in life are predictable, and you will regularly need to reassess your holdings. There may come periods of time or major life events when you want to radically alter the structure of your portfolio, possibly by making investments with maturity dates synchronized with those events. Being vigilant in keeping up with your portfolio will help ensure that your investments are on track with where you are in your life.

It is often the case (although by no means a rule) that younger investors have a greater tolerance for risk. With decades to ride out market cycles and refine your investing strategy, higher risks with larger returns are tempting. As you approach retirement, however, security becomes a greater priority, and your investment strategy is likely to change to reflect that.

In any case, you need to target a risk level with your diversification strategy, and zero risk is not an option. No risk would mean no losses, but it would also mean no returns. Diversification doesn’t guarantee against losses. That’s not even a goal of diversification. Rather, you are attempting to balance out your losses to keep your portfolio performing as you envision it.

The mechanics of diversification can be quite complex. You are looking at actions like allocating your investments among asset classes, analyzing the performance of individual assets, tracking market cycles and reacting to market corrections. These activities can be guided by complex mathematical formulae within a theoretical framework, as well as practical strategies that balance risk against expected returns through varying management philosophies. Professional guidance is recommended for most investors, especially those with limited experience.

Even with professional management, you want to understand your choices and make an informed decision. It is worth repeating that this is a highly complex topic, but here are the basics.

Risk

Risk can be divided into a variety of types, but there are two basic categories: systematic and unsystematic. Systematic risk (also referred to as aggregate, undiversifiable, or market risk) is risk that affects entire economies or segments of it. This is risk that is unavoidable. Natural disasters are examples of systematic risk—everything in their range is destroyed, without regard to specific economic activity.

Systematic risk is not always that all-encompassing, however. Economic depression and recession are also examples of systematic risk—broad swathes of asset classes lose value simultaneously. Bonds may do well in those conditions, however. Government regulation can also pose systematic risk. The effect of the 18th Amendment to the U.S. Constitution (commonly known as Prohibition, 1920-1933) on the brewing and distilling industries in the United States is an extreme case, and there are many more examples of regulatory risk.

Unsystematic risk (also known as diversifiable, idiosyncratic, or business risk) is the risk inherent in a specific asset or business. If the company’s only factory burns down, it is the outcome of unsystematic risk. Bad management, embezzlement, and strikes are more sources of unsystematic risk. Risk of this type can be broken down into many subcategories—compliance risk or operational risk, for example—but they all share the characteristic of occurring in a relatively narrow context compared to systematic risk. That is the reason they are considered easier to counteract with diversification.

Correlation

Correlation, as the word implies, is movement in tandem. Any two assets can be compared and found to have full correlation, no correlation, or negative correlation. These relationships are usually expressed as +1, 0 and -1, respectively, although round numbers are rare. With this tabulation, you can choose assets that are not expected to behave the same way at the same time, and if one loses value, others should not. This method can be used within a sector, so that you can buy stock in two consumer goods producers if you are optimistic about that industry. This strategy can bolster your confidence that if one experiences a downturn, the other should not.

This also works with dissimilar assets. Returning to the example of Prohibition, we see that there is no amount of diversity of American distillery assets that could have saved you from a loss in 1920, but most other segments of the economy were left untouched. For example, your holdings in consumer goods would probably have been unaffected by Prohibition. Some assets may have even benefited.

Stocks and bonds are often cited as an example of diversification, since they typically show negative diversification. You may be familiar with some variation of the rule for stock and bond allocation based on 100 minus your age: a 30-year-old should have 70% stocks in their portfolio and 30% bonds, while a 70-year-old should have 30% stocks and 70% bonds. This is a simplification of the so-called Modern Portfolio Theory, devised by economist Harry Markowitz in 1952. While this rule of thumb is still often used, it should be noted that his thinking was quite a bit subtler than that.

Asset Classes

Asset classes are groups of investments that behave similarly, while behaving differently from other groups. Thus, the stock market as a whole rises and falls, even if individual stocks buck the overall trend. It’s worth noting, though, that the market’s behavior generally has little, if any, effect on real estate prices. There is no canonical list of asset classes. The list has grown in recent years, and may continue to grow. It commonly includes:

- Stocks, or equities, are units of ownership. Their value fluctuates with the financial performance of the organization that issued them, as well as under the influence of other factors, such as the state of the economy.

- Bonds, or fixed-income securities, are debts with a predetermined interest rate payable by the issuing corporation or governmental entity at their maturity date. Bonds are known for their low risk. They are as dependable as their issuer, and sometimes even more—Russia paid off the debts of the USSR after the latter collapsed. Bond interest rates tend to rise in times of economic downturn.

- Cash and money market instruments, of which certificates of deposit (CDs) are the best known, are subject to inflation and deflation.

- Foreign currencies trade in relation to your currency under the effects of monetary policy and conditions.

- Real estate market cycles are determined by a constellation of factors that include demographics, economic influences, construction material, and labor prices, and development trends. Real estate is often very expensive and has a low level of liquidity, so an investor may own a share of a property and use financing to purchase it.

- Commodities are raw materials and agricultural products—everything from corn to gold bullion. They are affected primarily by supply and demand, inventories, inflation, and currency fluctuations. Sometimes factors such as weather, regulation, and speculation can influence their prices as well.

- Cryptocurrencies are decentralized digital assets that can be used in financial transactions.

Asset classes are not the only parameters for diversification. You may also consider diversifying by holding time (long-term vs. short-term investments), market capitalization (large, medium or small companies), sectors and location. Furthermore, mutual funds and exchange-traded funds (ETFs) are made up of a selection of assets and already diversified when you purchase shares. They differ in the ways they are managed and sold.

Regardless of how you decide to put your portfolio together, it will need at least occasional adjustment to keep it on track to meeting your goals. This process is known as rebalancing, and it should be done no less than annually. Once again, this a moment when it would be advisable to work with a qualified wealth manager.

THE REALITIES OF DIVERSIFICATION

The benefits of diversification should be clear by now. Some caution is in order as well, however. Human nature can overcome some of the best practices of diversification if we let it. In particular, investors can be tempted to acquire assets like collectors. Every asset is a commitment. It requires due diligence and regular maintenance efforts, and it should enhance your portfolio’s performance in some specific way. Every asset has transaction fees and management fees attached to it as well. So, investments should be targeted.

Second, investing requires patience. Some of your assets will be high earners while others just sit there, or maybe even lose value. That’s the way it should be, and the situation will change, so don’t throw everything you have at a sudden winner, or sell off everything that is underperforming at a given moment. Keep that balance steady. You decided on a risk level through an assessment of your values and goals. It is going to suit you well. If you become timid and diversify your portfolio until it has no level of risk, you won’t meet your goals. Conversely, don’t throw your planning away for the sake of an opportunity that amounts to a get-rich-quick scheme. The chances of that turning out the way you hope are very low.

A reliable way to keep your portfolio on track is with professional wealth management. Firms like SD Mayer have long experience and expert advisers who can help you diversify your portfolio and take other steps that bring you closer to your long-term goals. Contact us today to find out more.

DISCLAIMER:

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. The services of an appropriate professional should be sought regarding your individual situation.