The IRS has released its 2026 cost-of-living adjustments for over 60 tax provisions, and it's time to factor these new numbers into your 2025 year-end tax planning. The One Big Beautiful Bill Act (OBBBA) has made significant changes, either making permanent or amending many provisions from the Tax Cuts and Jobs Act (TCJA). Let's break down what this means for you.

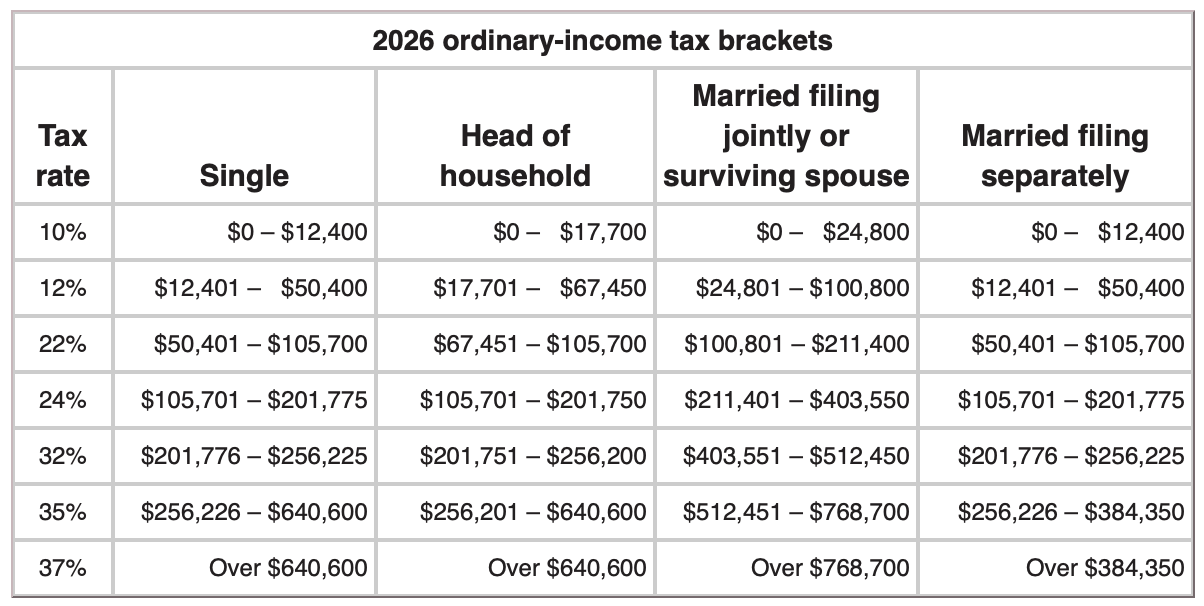

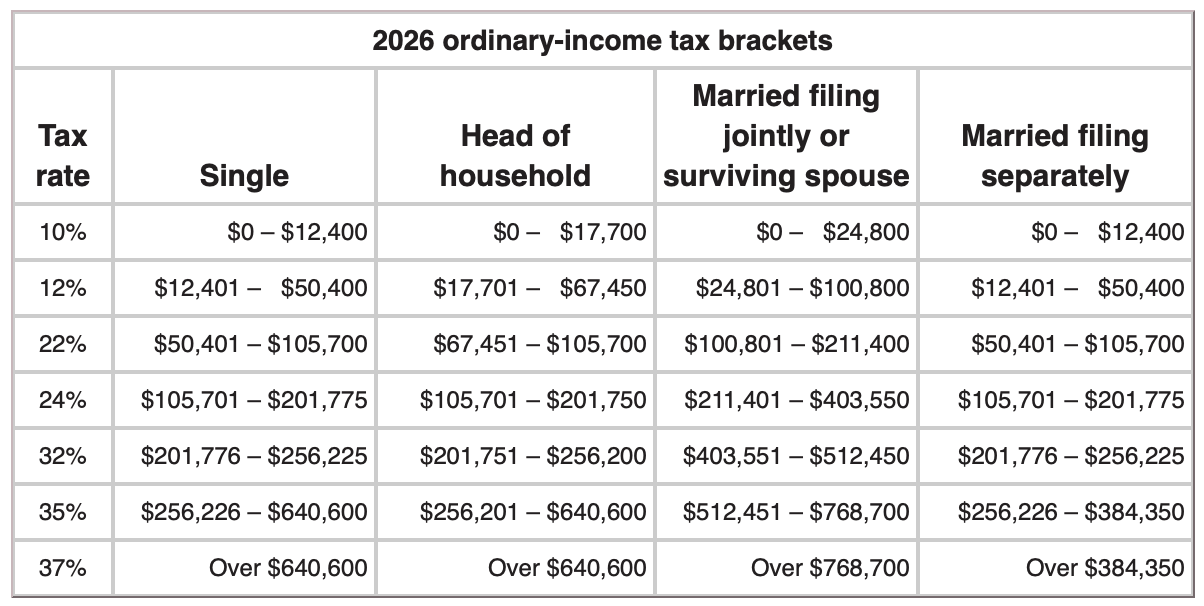

Individual Income Tax Rates

Tax-bracket thresholds are set to increase for all filing statuses. While this happens every year, the increases are more substantial for higher income brackets. For instance, the top of the 10% bracket will go up by $475–$950, but the top of the 35% bracket will see a much larger jump of $8,550–$17,100, depending on your filing status.

These current rates and brackets are permanent and they will continue to be indexed for inflation annually.

Standard Deduction

The OBBBA makes the nearly doubled standard deduction from the TCJA permanent and gives it a slight boost. These amounts will also continue to be adjusted for inflation each year.

For 2026, the standard deduction will be:

- $32,200 for married couples filing jointly

- $24,150 for heads of households

- $16,100 for singles and married couples filing separately

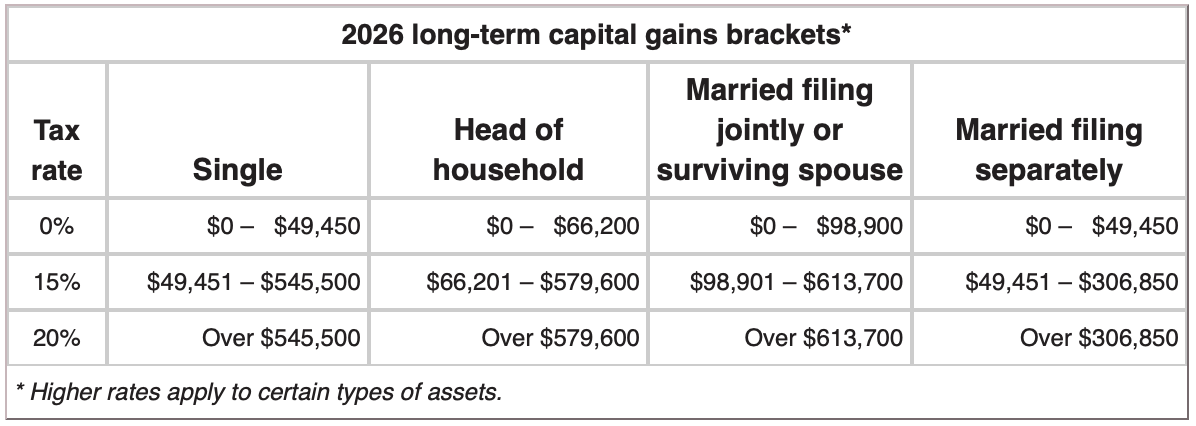

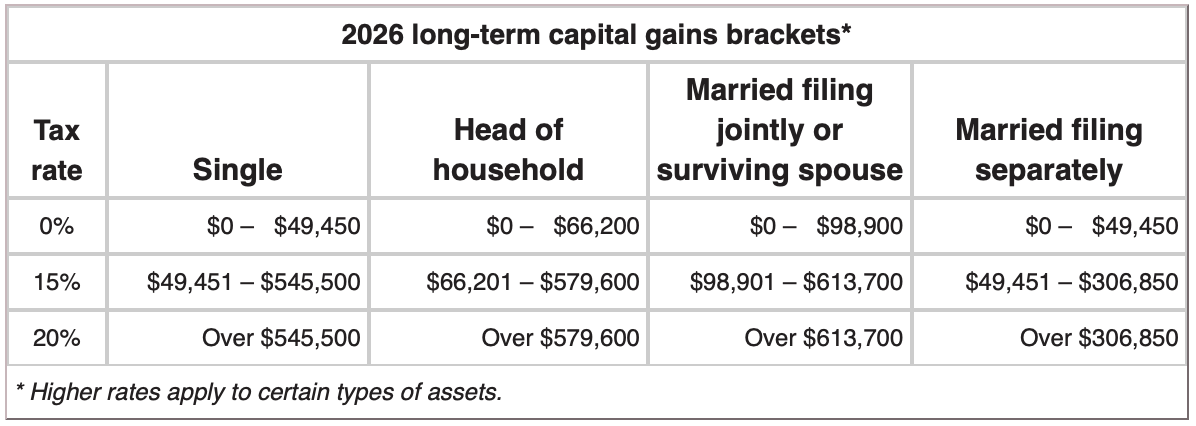

Long-Term Capital Gains Rate

This rate applies to profits from investments you've held for over a year. The rates remain at 0%, 15%, or 20%, based on your income. The 20% rate for top earners kicks in before you hit the highest ordinary-income tax bracket.

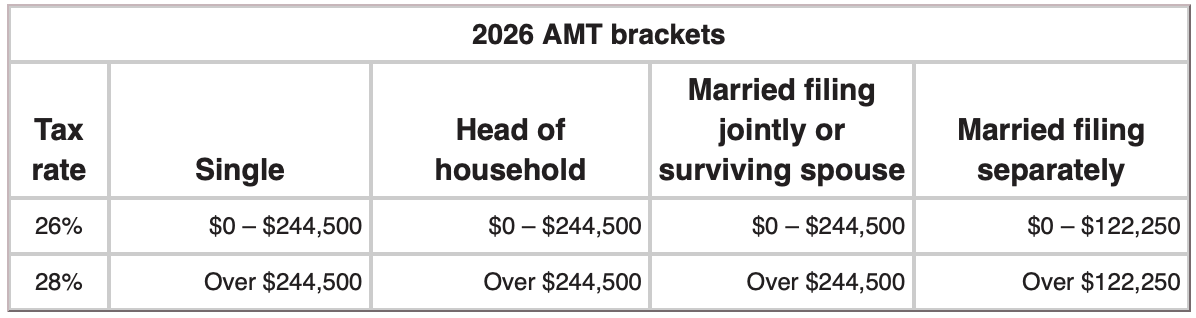

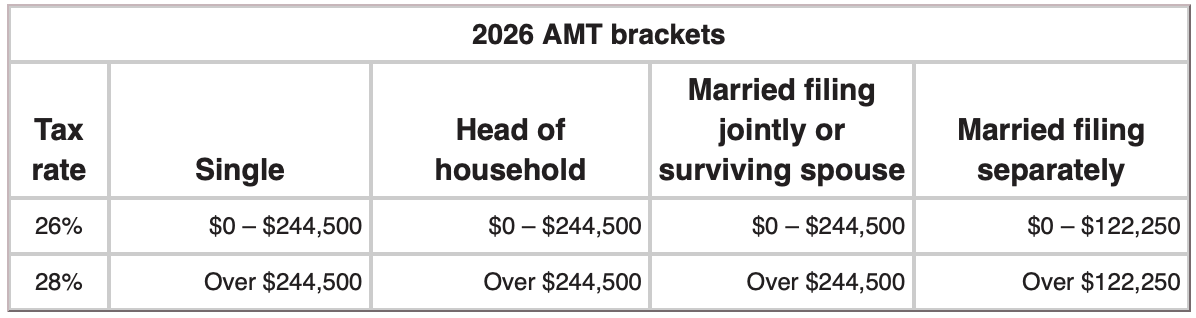

Alternative Minimum Tax (AMT)

The AMT is a parallel tax system that can affect taxpayers who have certain deductions or income items. If your AMT liability is higher than your regular tax, you pay the AMT.

The TCJA significantly increased the AMT exemption amounts, and the OBBBA has made these higher exemptions permanent while continuing to index them for inflation. For 2026, the exemptions are:

- $140,200 for joint filers (a $3,200 increase from 2025)

- $90,100 for singles and heads of households (a $2,000 increase from 2025)

However, there's a critical change to the phaseout ranges for this exemption. The OBBBA reverts the income thresholds to 2018 levels and makes the phaseout happen twice as fast. This means the phaseout ranges are now significantly lower than in 2025, which could expose more taxpayers to the AMT.

Child-Related Tax Breaks

Several child-related tax benefits are adjusted for inflation, but the income phaseouts can limit eligibility.

Here’s the rundown for 2026:

- The Child Tax Credit: The OBBBA permanently sets the credit at $2,000 per child, which was increased to $2,200 for 2025. Due to low inflation, it will remain at $2,200 for 2026. The refundable portion also stays at $1,700. A crucial point to remember is that the income phaseout thresholds are not indexed for inflation and are permanently set at $400,000 for joint filers and $200,000 for other filers.

- The Adoption Credit: The maximum credit will increase by $390 to $17,670 in 2026. The income phaseout range for this credit will be $265,080–$305,080. The refundable portion of the credit will be $5,120.

Gift and Estate Taxes

The OBBBA brings great news here. Instead of reverting to a lower, inflation-adjusted $5 million, the gift and estate tax exemption and the generation-skipping transfer (GST) tax exemption are permanently increased to $15 million for 2026, with annual inflation adjustments to follow.

The annual gift tax exclusion remains unchanged from 2025 at $19,000 per person, per recipient.

Navigating Your Tax Strategy for 2026

With many of these cost-of-living adjustments trending higher, there are new opportunities for tax savings. However, the changes to the AMT phaseout ranges could create new challenges.

Understanding how these numbers impact your unique financial situation is key to building a smart tax strategy. If you have questions about how to best position yourself for 2026, please don't hesitate to contact us. SD Mayer is here to help you make sense of it all.

SECURITIES AND ADVISORY DISCLOSURE:

Securities offered through Valmark Securities, Inc. Member FINRA, SIPC. Fee based planning offered through SDM Advisors, LLC. Third party money management offered through Valmark Advisers, Inc a SEC registered investment advisor. 130 Springside Drive, Suite 300, Akron, Ohio 44333-2431. 1-800-765-5201. SDM Advisors, LLC is a separate entity from Valmark Securities Inc. and Valmark Advisers, Inc. Form CRS Link

DISCLAIMER:

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. The services of an appropriate professional should be sought regarding your individual situation.

HYPOTHETICAL DISCLOSURE:

The examples given are hypothetical and for illustrative purposes only.